In today’s dynamic economic landscape, managing your finances effectively is crucial for achieving stability and success. Whether you’re striving to build wealth, save for retirement, or weather uncertain times, these ten tips will help you navigate the intricacies of the economy and secure your financial future.

1. Create a Budget

A budget is the foundation of good financial management. Take the time to assess your income and expenses, and allocate funds to essential categories such as housing, groceries, utilities, and savings. Tracking your spending habits will help you identify areas where you can cut back and prioritize your financial goals.

2. Build an Emergency Fund

Life is full of unexpected expenses, from car repairs to medical bills to job loss. Building an emergency fund is essential for weathering these financial storms without derailing your long-term plans. Aim to save three to six months’ worth of living expenses in a high-yield savings account to provide a financial safety net.

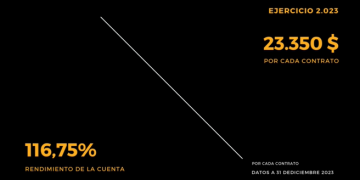

3. Invest Wisely

Investing is a powerful tool for building wealth over time, but it’s essential to approach it with caution and diligence. Educate yourself about different investment options, such as stocks, bonds, mutual funds, and real estate, and consider seeking professional advice if needed. Diversify your investment portfolio to minimize risk and maximize returns.

4. Pay Off Debt

Debt can be a significant obstacle to financial freedom, so make it a priority to pay off high-interest debt as quickly as possible. Focus on tackling credit card balances, personal loans, and other forms of consumer debt while making minimum payments on lower-interest loans. Consider consolidating debt or negotiating with creditors to reduce interest rates and accelerate repayment.

5. Live Below Your Means

Living below your means is the key to long-term financial stability and prosperity. Avoid succumbing to lifestyle inflation by resisting the urge to upgrade your possessions every time you receive a raise or windfall. Cultivate frugal habits, prioritize needs over wants, and seek out cost-effective alternatives whenever possible.

6. Plan for Retirement

It’s never too early to start planning for retirement. Take advantage of employer-sponsored retirement plans such as 401(k)s or IRAs and contribute regularly to take advantage of tax benefits and employer matches. Consider consulting a financial advisor to develop a personalized retirement savings strategy based on your goals, risk tolerance, and time horizon.

7. Stay Informed

Keeping abreast of economic trends, market developments, and financial news is essential for making informed decisions about your money. Follow reputable sources of information, such as financial publications, websites, and podcasts, and stay skeptical of sensationalized headlines or speculative advice. Knowledge is power when it comes to navigating the economy.

8. Protect Your Assets

Safeguarding your assets against unforeseen risks is an integral part of financial planning. Review your insurance coverage regularly to ensure you’re adequately protected against potential threats such as accidents, illnesses, natural disasters, and lawsuits. Consider purchasing umbrella liability insurance for an extra layer of protection beyond standard policies.

9. Invest in Yourself

Your most valuable asset is yourself, so invest in your education, skills, and personal development to enhance your earning potential and career prospects. Pursue opportunities for lifelong learning, attend workshops and seminars, and seek out mentors who can provide guidance and support. Continuously improving yourself will pay dividends in the long run.

10. Stay Flexible

The economy is inherently unpredictable, so it’s essential to remain flexible and adaptable in your financial planning. Be prepared to adjust your strategies in response to changing circumstances, whether it’s a shift in market conditions, a career transition, or a major life event. Embrace a mindset of resilience and resourcefulness to thrive in an ever-evolving economic landscape.

By implementing these ten tips, you can navigate the complexities of the economy with confidence and achieve financial success. Remember, the key to building wealth and security lies in prudent decision-making, disciplined saving and investing, and a willingness to adapt to changing circumstances. With careful planning and perseverance, you can overcome economic challenges and achieve your long-term financial goals.