Economics is a multifaceted discipline that explores the production, distribution, and consumption of goods and services within society. At its core, it delves into how individuals, businesses, governments, and nations allocate resources to satisfy their needs and wants. Here are five fundamental concepts that are crucial to grasp when studying economics:

1. Supply and Demand: Supply and demand form the backbone of economics, influencing prices, production levels, and market behavior. The concept revolves around the relationship between the availability (supply) and desire (demand) for a product or service. When demand exceeds supply, prices tend to rise, encouraging producers to increase output. Conversely, when supply surpasses demand, prices often decrease, prompting producers to reduce production. Understanding supply and demand dynamics helps economists predict market trends and analyze consumer behavior.

2. Scarcity: Scarcity refers to the limited availability of resources relative to unlimited wants and needs. In essence, it highlights the perpetual challenge of allocating finite resources efficiently. Scarce resources include natural resources, labor, capital, and time. Economists study how societies prioritize and allocate these resources to produce goods and services. Efficient resource allocation is essential for maximizing societal welfare and achieving economic growth.

3. Opportunity Cost: Opportunity cost is the value of the next best alternative forgone when a decision is made. In other words, it represents the benefits that could have been gained by choosing an alternative course of action. Every decision involves trade-offs, where choosing one option means sacrificing another. Understanding opportunity cost helps individuals, businesses, and governments make informed choices by evaluating the potential benefits and drawbacks of different alternatives. By considering opportunity costs, stakeholders can allocate resources more effectively and optimize outcomes.

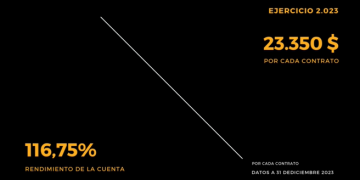

4. Inflation: Inflation refers to the sustained increase in the general price level of goods and services over time. It erodes the purchasing power of money, as individuals can buy fewer goods and services with the same amount of currency. Moderate inflation is generally considered beneficial for economic growth, as it incentivizes spending and investment. However, high or hyperinflation can have detrimental effects on an economy, leading to uncertainty, reduced consumer confidence, and erosion of savings. Central banks closely monitor inflation and employ monetary policy tools to maintain price stability within an optimal range.

5. Gross Domestic Product (GDP): Gross Domestic Product (GDP) is a key indicator used to measure the economic performance of a country. It represents the total monetary value of all goods and services produced within a nation’s borders over a specific period, typically a year or a quarter. GDP encompasses consumption, investment, government spending, and net exports (exports minus imports). It provides insights into the overall health and growth trajectory of an economy. Economists analyze GDP trends to assess economic stability, productivity, and standard of living. However, GDP has its limitations, as it does not account for factors such as income inequality, environmental degradation, and non-market transactions.

In conclusion, economics serves as a lens through which to understand how societies allocate scarce resources to fulfill their needs and desires. By grasping these fundamental concepts of supply and demand, scarcity, opportunity cost, inflation, and GDP, individuals gain insights into the dynamics of economic decision-making and the complexities of market interactions. These concepts provide a solid foundation for navigating the intricacies of economic theory and policy.